|

|

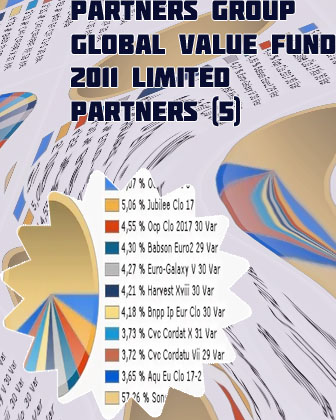

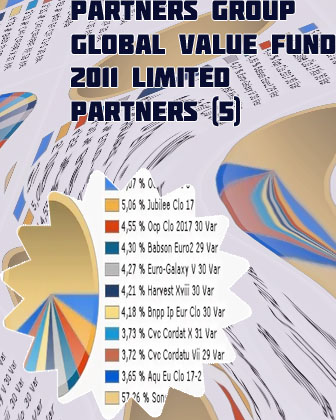

Partners Group Global Value 2020 Fund Investment Strategy

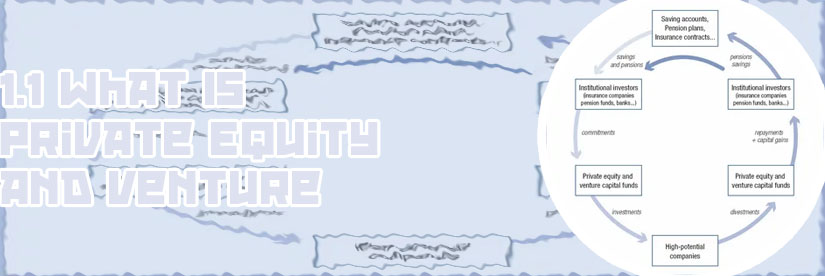

This programme focuses on three key pillars: venture capital; private markets; and FinTech start-ups. These three financial pillars are studied in combination; with comparisons and links drawn between them throughout the programme. The combination and contributions of these pillars will allow you to gain a more comprehensive understanding of this financial field. Private equity coursera Investment insights From Leading Experts

Private equity and venture capital coursera

However, venture capital financing will remain a critical part of the startup funding landscape for the foreseeable future. According to the National Venture Capital Association’s annual yearbook, there are 1,328 active U.S. VC firms representing $444 billion in combined assets under management - nearly as much as the largest U.S. private equity firms. Moreover, the unique expertise and strategic guidance that VC firms can provide, as well as connections to other investors, startups, and potential employees, is worth the sacrifice in equity and control for many entrepreneurs. Global Business and Economics (MA) The Master Fund estimates the fair value of its Private Equity Investments in conformity with U.S. GAAP. The Master Fund’s valuation procedures (the “Valuation Procedures”), which have been approved by the Board, require evaluation of all relevant factors available at the time the Master Fund values its investments. The inputs or methodologies used for valuing the Master Fund’s Private Equity Investments are not necessarily an indication of the risk associated with investing in those investments.

PRIVATE EQUITY MASTER PACKAGE

Liquid private markets Our liquid private markets vehicles invest in exchange-listed securities within the private equity, infrastructure and income asset classes. They offer investors daily liquidity and the possibility of a relatively small initial investment. 2. The Private Equity Associate from Financial Edge Valuation (Finance), Venture Capital, Venture Capital Financing, Private Equity

Private equity and venture capital bocconi

Save my name, email, and website in this browser for the next time I comment. Partners Group Global Value Fund Colleen Collins is a Managing Director of Blue Owl and member of the Oak Street Investment Team. Blue Owl is a global alternative asset manager with $132.1 billion of assets under management (as of September 30, 2022). Anchored by a strong permanent capital base, the firm deploys private capital across Direct Lending, GP Capital Solutions and Real Estate strategies. Blue Owl’s Real Estate division, Oak Street, is a leader in providing real estate solutions and structuring sale leaseback transactions with investment grade and creditworthy tenants.

|