|

|

Capital and financing supports for entrepreneurs

For an accredited investor with an investment horizon of at least five to seven years and a minimum of $50,000 to devote to venture capital investing, iSelect is another startup market. Investors who create their own venture capital fund by investing as little as $5,000 in 10 or more companies to create a fund. Tech venture capital Many VC’s will limit their investments to a specific start-up idea or industry. Some only make significantly large investments and have a $1 million or even $5 million minimum investment threshold. For this reason, you may want to eliminate these firms from your list that don't invest in companies within your industry, or the ones with an investment amount minimum that exceeds what you need.

Best tech venture capital firms

In a Holon IQ education market survey, 40% of respondents forecast the K-12 market in their country to improve in the next six months. Deep Tech Venture Fund Median valuation of seed-stage B2B companies raising in Q3 2022.

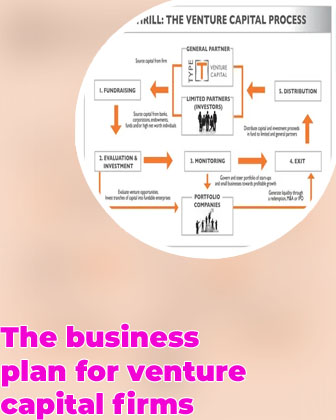

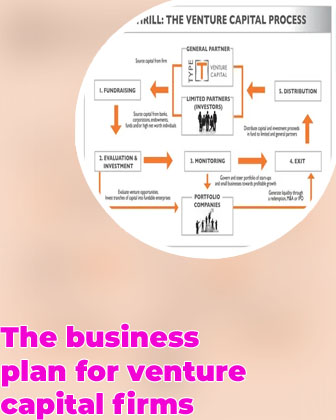

How does it work?

Often considered the closest thing to “free money” that you could ever obtain for your business, grants for small business are a form of startup funding that require no repayment, unlike like debt, and no trade of equity, unlike venture capital. Invest in world changing ideas Our newsletter delivers insights, inspiration and events to keep you growing and knowing.

Vc investment

.chakra .wef-1ppuv6fLicense and Republishing Why Some Businesses Should Not Take Venture Capital Funding The art of venture investing isn’t a solo endeavor. As with any successful business or sports team, you need to integrate great talents and minds into your system, while building a continuous performance culture to deliver premium returns. Successful investing means empowering employees to speak up, bring ideas to the table and have the confidence to follow through on their convictions.

|