|

|

BE THE FIRST TO KNOW

A number of Canadian Fund Managers have expanded outside of Canada. This knowledge article will outline a variety of key considerations those managers should consider before moving their operations outside of Canada. This knowledge article is not designed to be all inclusive and managers must ensure to obtain appropriate professional advice as every business has unique factors to consider. Stand alone hedge fund structure The second feeder, known as the “offshore feeder”, will normally be an offshore company known as a “blocker corporation”. It is into this offshore feeder that the non-US and US tax exempt investors will invest. Investment into a blocker corporation means that any US tax liability and any requirement to fill in a US tax return arises at the master/feeder fund level and does not affect the investors themselves.

Stand alone fund structure

Website Privacy Notice How to choose a state to open an offshore fund in Investment Funds

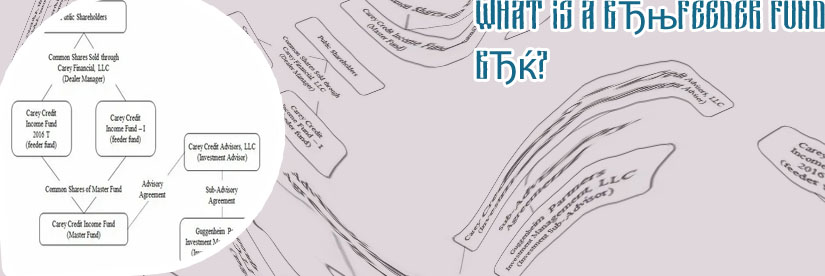

What is a Master-Feeder Structure?

Tax-advantaged partnership status Deal of the Year: the shortlists for capital markets, banking and finance and project finance The feeder fund and the master fund operate as separate legal entities. For example, in the US, a master fund is established as an offshore entity, thus enabling it to accept investment from different investors. Also, a feeder fund may be invested in more than one master fund.

Feeder fund structure

Close to 87% of all listings on the Cayman Islands Stock Exchange (CSX) are made up of investment funds. The CSX has plenty of experience in listing investment funds such as hedge funds, umbrella funds, mutual funds, feeder funds, and various specialist funds. Should someone want to establish a hedge fund in the Cayman Islands, there is a vast pool of talented and experienced people in the fields of accounting, law, fund administration, and backoffice-type support ready to help out. What Is a Master-Feeder Structure? To mitigate the effects of double taxation, a unique structure is used where a fund has a mix of both US and non-US investors. We refer to this setup as the ‘US Investors Module’.

|